As post-Brexit market turmoil begins to ease, start-ups fear that Britain’s exit from the European Union could threaten access to enterprise capital and private equity. Despite The UK ranks high in the rankings when it involves startup acceleration, startups are already here reported look elsewhere.

The UK has some benefits for startups, including largely effective regulatory agencies and relatively modern contract and industrial law. The UK also has well-functioning financial markets and access to the EU single market (allowing free movement of labour).

Brexit has threatened access to this single market, although it has not undermined many of the attractive legal and financial the explanation why startups decide to operate in the UK. Ultimately, the impact of Brexit on startups will depend largely on how the UK structures future immigration rules, what trade deals it enters into, and how the UK responds to potentially aggressive regulatory competition aimed at attracting startups.

Access to financing

One possibility arising from Brexit is that enterprise capital and private equity funds in the UK will find it tougher to access capital for start-ups. These funds obtain capital from investors, which they then invest in portfolio firms (startups).

In particular, the European Investment Fund (EIF), which provides large amounts of funding for enterprise capital (in Europe from 30 to 50%.), which is targeting start-ups, may consider limiting its investments in the UK. The EIF operates not only in EU Member States, but also in EU candidate and potential candidate countries and in European Union countries Countries of the European Free Trade Association.

So future capital will depend on whether and to what extent the UK can seek to turn out to be a European Free Trade Association country. Currently, funding uncertainty would discourage enterprise capitalists from planning future funds in the UK if there is a viable and well-funded alternative elsewhere.

In fact, investors of all types do not like uncertainty. Greater uncertainty generally means greater risk (and a higher cost of capital), which reduces the present value of future money flows.

Until the UK and EU complete negotiations, UK funds’ portfolio firms in Europe (or European subsidiaries) will face greater money flow risk, which in turn reduces fund valuations and affects “limited partnerships” willingness to speculate.

Another factor influencing investing in start-ups is the devaluation of the pound. For US investors, a fall in the pound reduces the value of their investments in domestic currency. This essentially reduces their potential profits.

To some extent, once the pound stabilizes, this problem will ease. However, post-referendum, predicting currency movements adds an additional layer of uncertainty.

Startup employees

Previously, the UK benefited from free movement of employees inside the EU. This enables start-ups to simply attract employees from other EU countries, who will in turn be assured of having the ability to live and work in the UK for so long as they need.

The apprehension is that difficulties immigrating to the UK could reduce the pool of employees that start-ups can access. This is largely based on the UK imposing burdensome immigration rules that may prevent expert labor from moving to the UK. The UK doesn’t have to do this. Indeed, the UK could allow free immigration from EU countries after Brexit, even if other EU countries do not reciprocate.

Given that the UK has not yet defined an exact system (but that may remind Australian immigration system, which emphasizes expert immigration), it is unclear how big a problem this may actually be.

Regulatory competition from other markets

One issue is that once it loses access to the single market, the UK may be more vulnerable to regulatory competition from other markets. Specifically other EU countries he could try attract start-ups by offering relatively lower taxes or more favorable corporate regulations.

This option has been available for some time, but not all startups have fled the UK. This implies that when the UK had access to the single market, it had one other advantage over its EU competitors. These may include the legal system, the financial sector and financial markets.

This is because the UK consistently scores high in terms of judicial qualityand rule of law. Indeed, in comparison with its most ceaselessly mentioned rivals, Ireland and Switzerland, the UK also scores highly on contract enforcement.

The UK could also alleviate any such concerns by introducing more of its own incentives for research and development, tax and start-ups. Indeed, start-ups in the UK are currently receiving significantly more funds from the government than their US counterparts.

The UK also has a fairly well-developed set Rules and regulations regarding the creation and financing of enterprise capital funds and the system tax breaks for research and development. While the UK could improve its incentives for start-ups, it is flawed to match the UK to other generous countries (e.g. Ireland).

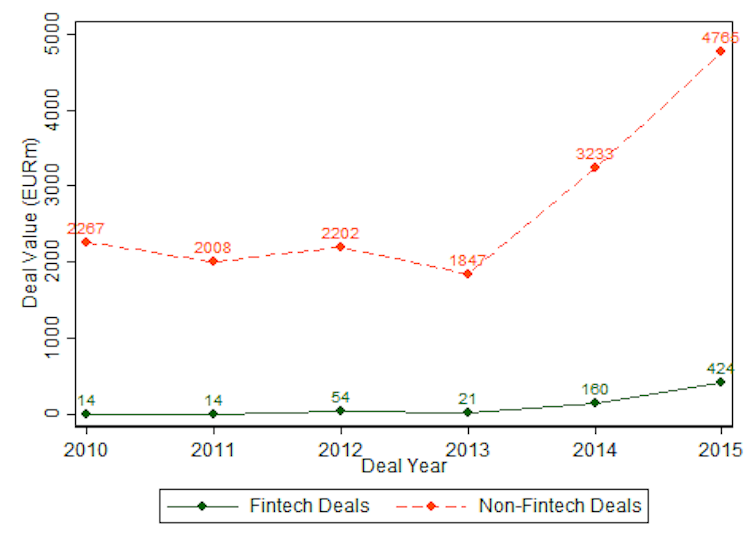

Brexit could also mean that startup regulations are split between the EU and the UK, adding regulatory hurdles, particularly for financial technology (fintech) startups. However, fintech startups represent a relatively small segment of the startup market, each in terms of deal volume and deal value (see charts below).

According to data on all enterprise capital deals in the UK between 2010 and 2015, fintech deals make up just 10% of the size of all other enterprise capital deals. The charts below illustrate this trend based on Preqin data on the number and value of enterprise capital (VC) deals in the Fintech sector in comparison with other sectors (this chart is based on Preqin data and Preqin’s classification of portfolio company location and primary industry). Investment in fintech is still vital, but limiting the variety of fintech transactions will not cause the collapse of the UK start-up industry.

Prekin

Prekin

Export markets

There is perhaps a major concern about the impact of Brexit on the ability of British firms to export goods and services to the EU. The advantage of the single market is that UK-based businesses can access the EU with minimal trade barriers.

Leaving the EU will threaten such trading benefits. According to Open Europethe impact will vary by sector, but is prone to most adversely affect financial services.

Trade barriers would affect start-ups as much as established firms. Brexit may encourage businesses to relocate to other EU countries if the UK does not strike an appropriate trade deal with the EU and/or other countries that provide significant market opportunities.

Is the risk exaggerated?

Individually, Brexit poses some issues that are problematic but not definitely fatal. In the initial period of financing uncertainty resulting from exchange rate fluctuations and regulatory uncertainty, capital outflow is possible.

Currently, the predominant contenders for attracting startups from the UK are other EU countries. Non-EU countries could be attractive but would not have access to the EU single market and so may not offer an advantage over doing business in the UK. The predominant candidates for the EU are countries with attractive regulations and/or low taxes. Irelandfor example, is one such contender.

The long-term impact of Brexit and whether startups move to other markets will depend on several aspects: whether the UK is in a position to strike appropriate trade deals with the EU and other non-EU countries, how it structures immigration law, and how it responds to regulatory competition from (mainly) countries based in the EU. It would be higher for the UK to stay in the EU slightly than leave it and expose itself to those concerns.

In this area, there are no clear benefits to being outside the EU. However, this does not mean that there’ll be an exodus of startups and investors in the UK.

However, the UK has the opportunity to enhance its immigration and capital rules to encourage and maintain a vibrant start-up scene: the impact of Brexit on start-ups will ultimately depend on how the UK changes its regulatory environment.