Startup founders often wonder (and fear) when their growth will decelerate and eventually plateau.

Especially in the early days of product-market fit, the hustle and bustle and rapid growth often lead founders to overlook certain key metrics that ultimately determine the company’s growth limit.

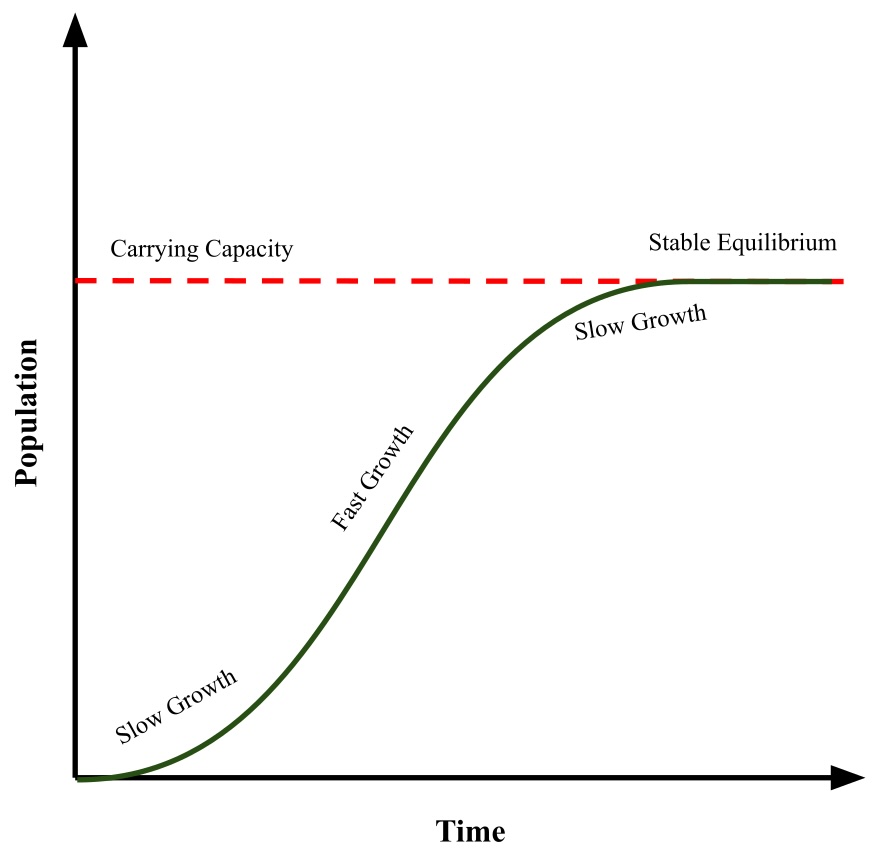

In biology and engineering, there is a concept called “carrying capacity”, which is often a measure of the final value of some capability, comparable to population growth or the volume of water in a lake.

For example, in the graph above, assuming constant reproduction and population inflow along with a constant death rate, the city’s population will initially grow slowly, then go through a period of rapid growth, eventually shrinking around capability and reaching a stable equilibrium.

When the inflow and outflow are relatively constant, the carrying capability becomes a constant number, asymptotizing towards a final value.

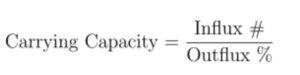

To calculate the final value of the system, we only need two numbers: the absolute amount of inflow and the percentage of outflow over the same period.

Using this simple formula, we will easily calculate the final ARR for your startup.

Using this simple formula, we will easily calculate the final ARR for your startup.

What is an ARR terminal?

The ARR terminal represents the balance point of your annual recurring revenue, where the amount of recent ARR added each 12 months is equal to the ARR lost through churn and downselling.

This is the maximum revenue your startup is expected to stabilize, taking into account current growth strategies and customer retention. This metric is vital for understanding when your small business will hit a revenue plateau and for planning beyond that time.

Terminal ARR Calculation: Simple formula

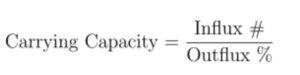

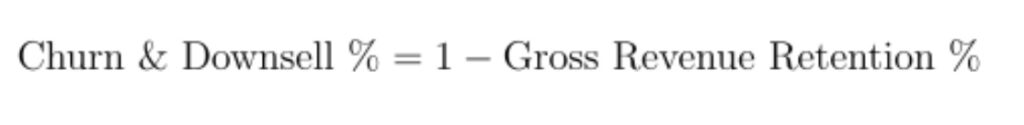

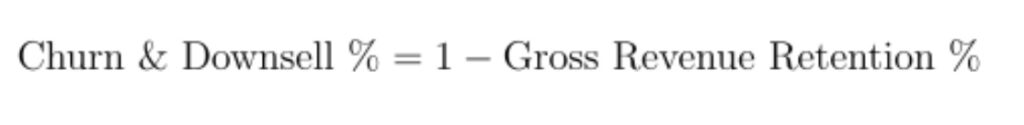

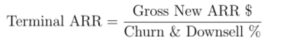

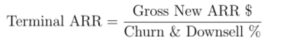

You can calculate your final ARR using just two numbers: gross recent ARR per 12 months and gross revenue retention rate. Using the gross revenue retention rate, you’ll be able to calculate the percentage of churn and down sales.

Using this number, find the ARR terminal using the deadweight formula.

Using this number, find the ARR terminal using the deadweight formula.

EXAMPLE:

EXAMPLE:

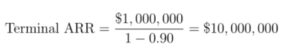

Imagine your startup plans to add $1 million in recent ARR every 12 months and your revenue retention rate is 90% (or 0.90).

Under current conditions, your organization will eventually stabilize at an ARR of $10 million. However, if your retention drops to 80%, your final ARR drops to just $5 million.

This is why many investors focus on the revenue retention rate for startups (also often known as the “leaky bucket problem”) because the sensitivity to revenue retention is quite high when it comes to calculating the final ARR.

Strategic implications

By understanding terminal ARR and key input metrics – gross recent ARR and gross revenue retention – you’ll be able to set priorities to improve or structurally change your small business.

To influence terminal ARR, you simply need to change one of two metrics: recent gross ARR or gross revenue retention. This will assist you set your priorities.

By focusing on higher-quality customers and implementing rigorous customer retention programs, you’ll be able to regularly increase revenue retention. However, on condition that revenue retention is measured over the course of the 12 months, it takes a good 12 months for your initiatives to make an impact.

The key is a long-term view and persistence in implementing a customer retention strategy.

Increasing gross recent ARR has more to do with your core value proposition/product, marketing and sales strategies, and overall funnel speed (e.g. sales cycles). Unless you sell products to Fortune 100 or traditional enterprises, this can likely be lower than 12 months, so having a solid revenue growth strategy from recent products and upsells can impact your final ARR a little faster.

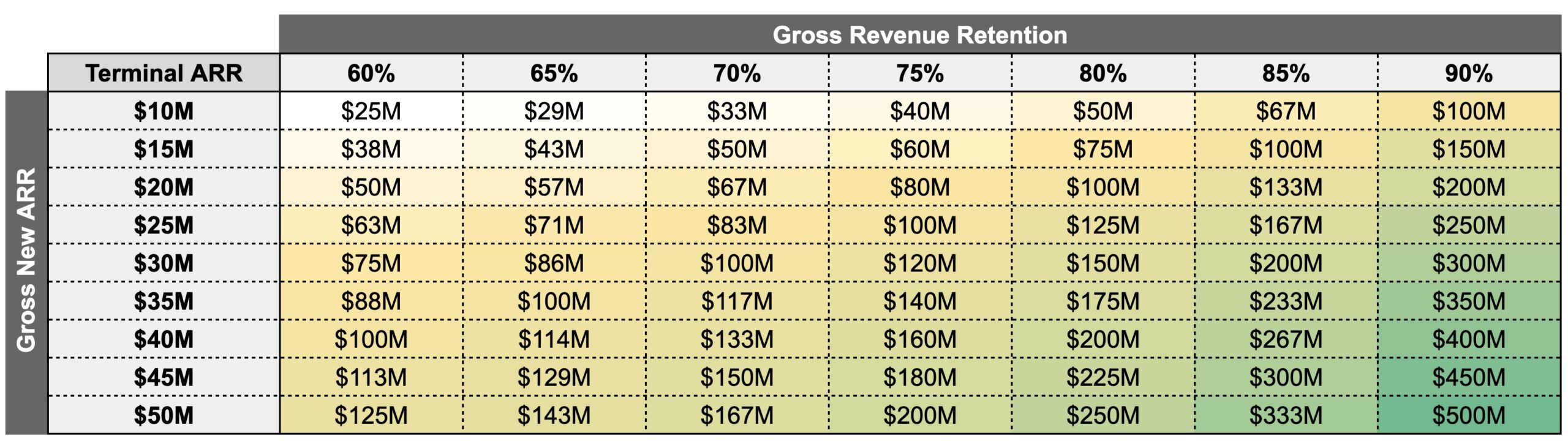

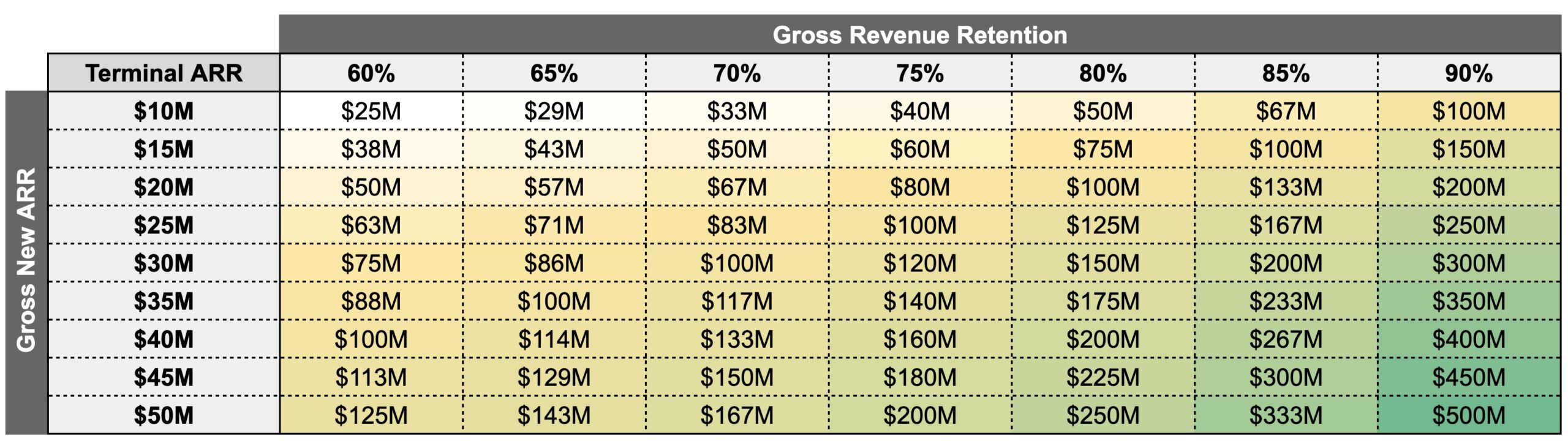

It’s vital to proceed to listen to each input metrics to make sure you’re maximizing your startup’s final ARR. The following shows how the combination of gross revenue retention and gross recent ARR affects the company’s terminal ARR.

In this instance, even with the same recent gross ARR, based on retention, the final ARR could have a 4x difference.

Once you understand your individual business and discover which metric is easier to move, you’ll have to set your priorities and strategies – all of your product and go-to-market efforts will have a direct impact on these numbers – and on your growth potential.